Spanish energy sector

The Spanish energy sector is surrounded by light and shade. The first is evident while in the second there are many areas in which the knowledge of the general public is lost. What is the energy mix? What is in the electricity bill? Up to what point can we depend on certain energy sources or certain countries to supply us? Electricity, fuels, natural gas, etc, are fully integrated in our life, so much so that it is inevitable to think about what we would do without them. We are so used to the presence of energy that we rarely think about where it comes from. Every story has a beginning.

Background: in our country, energy has traditionally been used intensively, that is, much was used with little efficiency, a phenomenon similar to that which occurred in the employment market.

In Spain, at the time, the government decided to subsidise energy to avoid increasing costs to consumers.

As can be imagined, the government of the time was clearly mistaken. By subsidising energy, it helped to perpetrate its waste and facilitated the permanence of a more inefficient industrial structure, making us less competitive with foreign countries.

The sooner the problem is detected, the sooner your energy structure is adapted to the real costs of the system, that is, you enter the energy variable in the costs structure and can readjust your energy competitiveness through energy investments. If the cost of energy is subsidised, we stop making these investments and the state closes its eyes to the tariff deficit until the limits to which we have arrived today with an accumulated deficit of nearly €30,000 M in the second quarter of 2013 and with a drop in demand that causes a reduction in income from tolls and complicates even further, if possible, the amortising of that deficit.

The Spanish energy mix

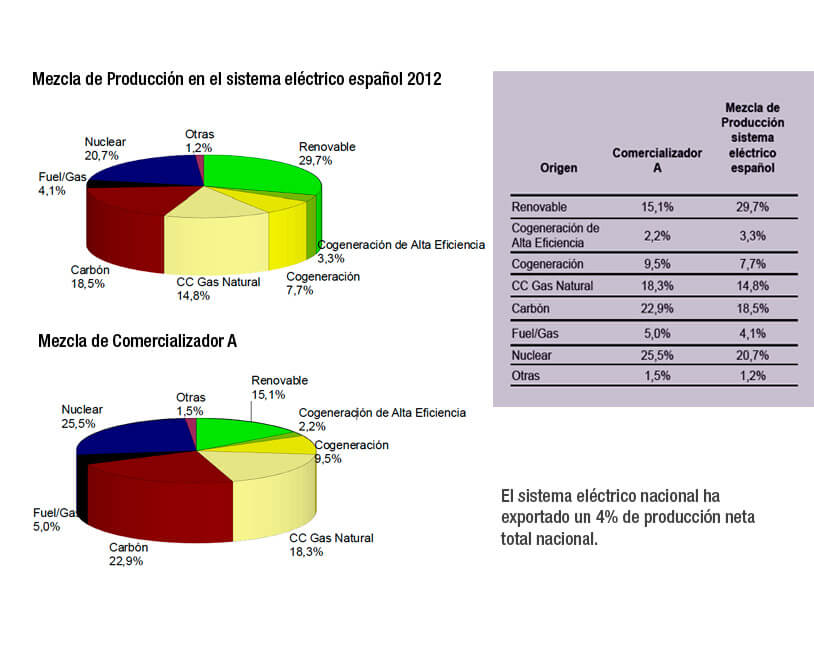

The energy mix of a country is none other than the set of energy sources from which the electricity consumed comes.

Although the electricity that reaches our homes is indistinguishable from that consumed by our neighbours or other consumers connected to the same electrical system, it is now possible to guarantee the origin of the electricity production that you consume.

For these purposes, a breakdown is given of the mix of national production technologies for comparing the average national percentages with those of the energy sold by your vendor company.

Our present and future

Our present and challenge is without doubt the tariff deficit.

The causes of the tariff deficit are the lack of competition in the energy sector, the costs structure of the electrical system being what they are, it is debatable whether the costs imputed to technical restrictions are correct or if the mechanism for assuming these costs could be improved or if the assumed costs of guaranteeing power are also those that are involved or if the coal subsidies or premiums for renewable energies must be adjusted, but what we believe is not negotiable is the creation of an in-depth reform of the auction system for setting energy prices since, at a glance, it does not appear very correct that energy such as water or nuclear power enter the same auction system as the rest of the energies that complete the Spanish energy mix since many of these installations are fully amortised and have production costs much lower than those competing with them in the market.

What will we achieve if we reform the auction system?

We will achieve a clear objective, that the cost of energy will plummet, to what extent we do not know but it is mathematically certain that removing water and nuclear power from the auction will lower the price if the regulation is undertaken correctly.

Once we manage to lower the energy price, we have two options. One is to increase the regulated part in the same proportion to pay the cost of the accumulated tariff deficit. This would amortise the debt and once we have emerged from this pit we could lower the regulated costs and be better positioned in the near future in the competitive market. The other is to not increase these costs, which would mean a direct reduction in the energy costs which could energise the economy by being more competitive with the exterior, also causing an increased demand that would imply an increase in the regulated income, thus being able to amortise the deficit.

It can be said louder but not clearer.

On the other hand, full energy liberisation could be an opportunity for business, for job creation, for energy independence and for re-balancing a system that has already withered. The disappearance of the last resort tariff, also called the voluntary price, for the small consumer is one of the pending obligations that the government must tackle if it intends to avoid increasing the deficit in the future.

Decisions cannot be taken to solve the problems of the present and take into account the consequences (effects on it) of the future (government and lobbies). Companies present accounts every three months and the politicians every four years. Neither of these time spaces are sufficient to manage our energy system well nor for the interests of our country.

Our immediate present: manage our energy system in another way, giving priority to public interests over individuals with suitable time horizons, or we will finish by destroying the already mistreated present…

Who's who!

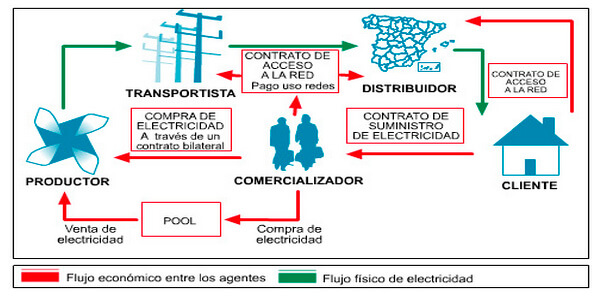

The main activities for supplying electricity are:

Generation: Generation is the entire industry dedicated solely to producing electricity. There are generators in ordinary regime (technologies of combined cycle, nuclear, coal, fuel and large-scale hydroelectric) and generators of special regime (renewable technologies, among others).

Transport: Due to the difficulty of storing electricity, the energy generated is transported directly to the consumer over the transport system. Transport is undertaken in high voltage (380 kV) to minimise losses in the system. Transport is a natural monopoly with the sole carrier and operator of the Spanish high voltage system being Red Eléctrica de España (REE), which manages, maintains and repairs this entire system.

Distribution: This is based on the consumption, operation and maintenance of distribution installations for supplying electricity to consumption points. Until the total disappearance of tariffs and, temporarily, until the appearance of last resort supply, it also includes the sale of energy to those end consumers or distributors who acquire the energy at a tariff (Endesa, Iberdrola. Gas Natural, E-on).

Sale: Sale consists of buying and selling electricity (www.omel.es). The vendors may acquire the energy on the daily and intra-daily market, on the deferred market, from generators in ordinary and special regimes and from other vendors, such as ATLAS ENERGIA. They can also sell energy to consumers through free contracting, either directly to the daily or intra-daily market, on the deferred market and to other vendors.

Regulatory bodies

These are bodies with regulatory and regulation capacity:

Liberalising of the energy sector

The liberalisation of electricity has developed gradually since 1997 and, as a consequence, the distribution companies have slowly ceded their role as electricity suppliers to vendor companies such as ATLAS® ENERGIA.

In the 1990s, Spain started the process of liberalising such diverse sectors as that of hydrocarbons and telecommunications. This process also affected the electricity sector, which saw how its regulatory framework became more flexible, allowing the free exchange of electricity in a market subject to competitive rules, the appearance of new agents in the sector and the free choice of supplier by consumers. All these measures were aimed at improving the efficiency of the sector and the quality of the service offered to its customers.

Benefits of liberalisation

In principle, the intention of liberalising tariffs was to lower the prices in the electricity bill. The more the consumers entering the free market, the more and better, supposedly, the offers put into play by the electricity vending companies. At least in the medium or long terms. This is something that already happened in other countries.

Homes:

76% of homes are subject to the government's TUR (last resort tariff) but this pricing does not appear to provide a saving for the consumer since it is a regulated tariff that is increasing…

What is the tariff deficit?

The definition and explanation of the tariff deficit has at least paradoxical components. The electricity tariff deficit is the difference between the cost of the electricity supply and the electrical tariff, that is, the price of electricity. Basically, the supply cost consists of the price of the energy and the regulated costs. The energy price is determined in the generation market while the regulatory costs depend on administrative or 'political' decisions, including the cost of transport, distribution, the renewable energy premiums, the cost of the extra-peninsular systems, the over-cost of the coal decree, the payment of the expired tariff deficit and its return, among others.

The reason why the tariff is therefore insufficient for its coverage is because, from the political point of view, it is assumed that the price of electricity is regulated so that the final price may be insufficient for the costs of which it comprises. The prices of electricity is one of the last prices controlled by the government, giving rise to a considerable controversy whenever the quarterly revision occurs. Other energy sources such as hydrocarbons or even natural gas are not persecuted by the emotional and political loads of electricity prices.

The tariff deficit has a double nature. On the one hand, it is a debt stock which increases as this tariff difference is not levelled. Then, on the other hand, there is the current deficit, the new deficit, generated in each of the tariff revisions. In these terms, the figures are a scandal, such that we are on the edge of €24,000 million accumulated, regardless of its financing, its own or other components or the evolution of these components, all questions that we will see in successive articles in the form of successive and didactic pieces.

By 2011 this deficit was almost €3,500 million (still pending settlement by the CNE) and the tariff measures taken by this executive at the start of the year (freezing the tariff without compensating the regulated part, ignoring the sentence of the Supreme Court) led to exceeding greatly the €1,500 million forecast for 2012. What sparked this process was the continued inability to comply with the programmes for extinguishing the deficit approved in successive decrees by the executive (and, it must not be forgotten, required by the European Union to facilitate its financial classification) and the financing difficulties in the economy.

Given the “political” nature of this deficit, there are some who claim “political” solutions to it that are little sophisticated. Thus, simplified alternatives are heard such as the so-called “removal” for the accumulated debt or taxation for future technologies, above all to sweeten the tariff increases or to avoid the budgetary impact on public accounting of obtaining improper costs from the electricity tariff.

The deficit has various properties that make it very peculiar. The first and main one is the fact that this debt comes from the consumption by customers/users 'at tariff.' This means that this debt is formed by a current consumption. Imagine that you have a debt not for buying a car but for buying petrol. Evidently, this makes little sense and managing energy prices in this way for a long time was easy and releasing for the fact of looking the other way. Today this is living riding on a tiger.

Challenges and obstacles

The sector is facing great challenges in the upcoming years. The following discusses what they are and how to tackle them together.

Intelligent optimising of energy systems and interaction with customers

Intelligent energy systems are at the epicentre of many of the changes occurring in the energy sector – the replacement of the most obsolete infrastructure, the introduction of clean energies, electric vehicles and many other challenges for the sector. All offer the potential to significantly reduce the inefficiency of the electrical systems, allowing a more interactive management of the demand, better integrating the energy sources distributed with the system, changing the customer's experience and facilitating new uses of energy.

Cleaner and renewable energies

Cleaner energies and the concerns about the regulation of emissions and energy efficiency are still one of the main priorities for many companies in the sector world wide. The companies are making great changes in the mix of fuels, investing in and deploying renewable and cleaner energy sources, including nuclear energy.

Mergers and acquisitions management for growth

Corporate operations are without doubt an important engine for contributing to the growth of energy sector companies and a means to acquire new capacity, technology and skills needed to tackle questions such as supply security and the generation of cleaner energy sources. Corporate operations are key for those companies wishing to increase their international presence and achieve a suitable balance in their portfolios. The appetite of external investors in the sector remains strong. The influence of international Chinese investors is also important and will grow in the future.

Managing capital and infrastructures projects successfully

The requirements of capital projects in the energy sector are immense. The International Energy Agency estimates that in only the energy sector, the accumulated world-wide investment required for 2010-2035 will be $16.6 million (in 2009 dollars).* The investment in optimised and more intelligent infrastructure systems, in new transmission systems to integrate renewable energy sources, in better inter-connectors and in replacing the most obsolete infrastructures are all pressing problems that nevertheless have little to do with investing in new generation capacity using fossil fuels, renewable energies or nuclear energy.

Improve performance and optimising day by day

In the current environment with higher energy prices, the pressure of the various stakeholders on companies in the energy sector to provide operational efficiency and effectiveness is greater than ever. The increase in production costs, the pressure exercised on the supply lines and the need to invest in an increasingly larger and more diversified infrastructure imposes significant additional costs on the value chain. The companies must foresee that it will continue to be difficult to transfer the costs to end users so that internal efficiency and performance will be even more vital. On the other hand, the intelligent management of assets is becoming increasingly important, especially in the context of the capital investment programmes at a time when it is necessary to build a large amount of infrastructures.

Maximum use of the regulatory environment

The energy companies' activities are affected by a wide range of regulatory requirements. As well as the financial information requirements, these companies must respond to the objectives of energy policy, to emissions and climate change objectives, to price and tariff requirements and a wide range of minimum service obligations. In addition, questions such as the regulation of data and security are increasingly important.

Changing market dynamics, including the prices of raw materials, supply and demand and cost structures

The energy sector is a mature sector but it continues to evolve and undergo important changes in its market dynamics. Featuring prolonged undertaking periods for its projects and large swings in its business cycle, the activity requires careful strategic planning and long-term approaches to achieve success.

Sustainability, climate change and supply security

Governments and consumers throughout the world demand greater security in the energy supply. In the developing economies, energy is synonymous with economic growth. In the developed economies, energy companies are asked to supply clean, easily available and reasonably priced fuels.

Recruit and keep a qualified staff

In the case of companies in the energy sector, the lack of qualified manpower continues to be an authentic challenge throughout the works. In some countries such as the United States, the average age of employees is nearly 50 and almost half of the professionals in the sector will reach retirement age in the next decade. Recruiting strategies and the capacity to keep employees in the sector are therefore increasingly important.